south dakota property tax records

Property Records South Dakota Search for free South Dakota Property Records including South Dakota property tax assessments deeds title records property ownership building permits zoning land records GIS maps and more. Main County Contact Information.

South Dakota Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in SD.

. Tax Records include property tax assessments property appraisals and income tax records. Click here for any questions about tax information. Please allow 7-10 business days to process if paying online.

The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property. Tax amount varies by county.

ViewPay Property Taxes Online. Spink County Redfield South Dakota. Please call our Customer Service department at 605-394-2163 for details.

Property owners may review the information that the county office has on. However it does not have access to individual tax records. Click here for the latest information on motor vehicle titling and registration.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes. A few South Dakota County Assessor offices offer an online searchable database. See Results in Minutes.

To view all county data on one page see South Dakota property tax by county. Be Your Own Property Detective. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

See Property Records Tax Titles Owner Info More. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Search Any Address 2.

104 N Main Street. Sioux Falls SD 57104. Property assessments are public information.

Property owners may review the information that the county office has on. Any person may review the property assessment of any property in South Dakota. Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty.

If you are a senior citizen or disabled citizen property tax relief applications are available through our office and our staff can assist you in filling out these forms. Ad South Public Records Search Free - Start With Just A Name State. Renew Your Vehicle Registrations Online.

Up to 38 cash back Property Tax Records. Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Spink County Government Redfield SD 57469.

KELO The South Dakota Department of Revenue is trying to provide property owners an opportunity to better understand how buildings and. Minnehaha County Commission Office. Land and land improvements are considered real property while mobile property is classified as personal property.

A South Dakota Property Records Search locates real estate documents related to property in SD. Please contact the Treasurers Office at 605 472-4583 for more information on income. The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information.

All special assessments are due in full on or before April 30. Any person may review the property assessment of any property in South Dakota. Please click HERE to go to payview your property taxes.

About Assessor and Property Tax Records in South Dakota. To find out information about a specific piece of property you must contact the county where the property is located. Email the Treasurers Office.

Our property records tool can return a variety of information about your property that affect your property tax. Ad Uncover an In-Depth Array of Information on Any Property Nationwide. When you provide a check as payment you.

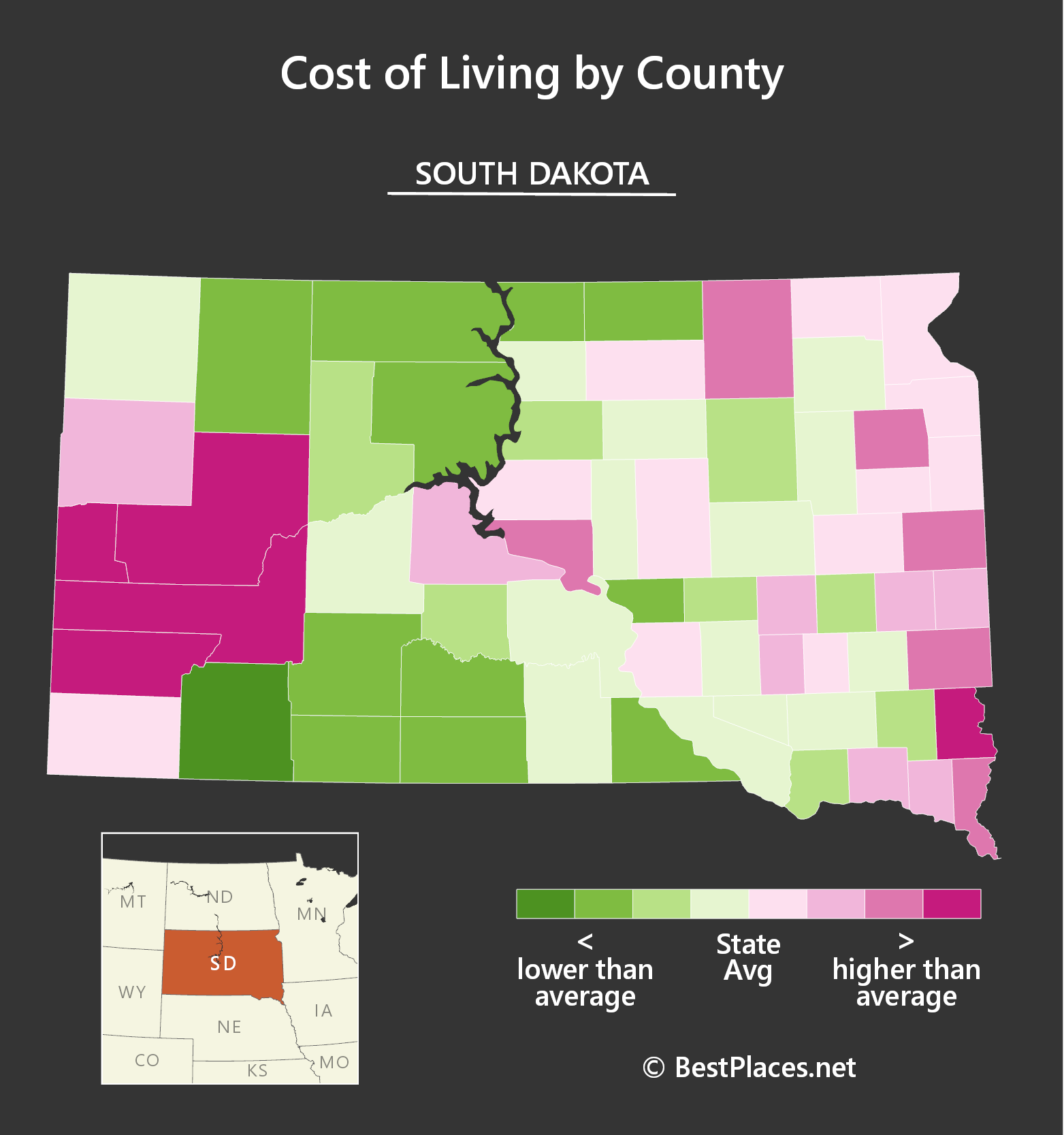

The second half of property tax payments will be accepted until October 31 without penalty. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Look Up Any Address in South Dakota for a Records Report.

To look up property tax records in South Dakota youll need to contact the county assessors office in the county where the property is located. The South Dakota Property Tax Division maintains information on property taxes including real property taxes in South Dakota. South Dakota real and personal property tax records are managed by the County Assessor office in each county.

Search For Title Tax Pre-Foreclosure Info Today. Aug 16 2022 0312 PM CDT. South Dakota Registry of Deeds Offices The South Dakota Register of Deeds Office is responsible for recording preserving and maintaining all real estate-related documents for the state.

Property assessments are public information. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. If taxes are delinquent please contact the Treasurers Office for the correct payoff amount and acceptable forms of payment.

Most credit cards are an acceptable means of payment with the exception of American Express.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Free South Dakota Quitclaim Deed Form How To Write Guide

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Best Places To Live In Sioux Falls South Dakota

South Dakota Retirement Tax Friendliness Smartasset

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Property Tax South Dakota Department Of Revenue

Register Of Deeds South Dakota Department Of Revenue

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

6 Mount Marty College Yankton South Dakota Yankton Day Trip

South Dakota Assessor And Property Tax Records Search Directory

Owning Land In South Dakota Pros Cons In 2022 South Dakota Dakota Cheap Land

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue